IBM is “testing a quantum-enhanced LLM that can predict future market moves,” claim leakers

Evaluating the claim that IBM is experimenting with a quantum-enhanced LLM capable of predicting market movements.

Claim: IBM has a secret prototype that can predict stock movements perfectly.

Verdict: False — zero-error market prediction is impossible and unsupported by any evidence.

Anonymous posts claim IBM has secretly merged its quantum hardware with a next-gen language model to create a system that can “see market events before they happen.” The rumour insists this hybrid model can forecast stock movements, corporate failures, and even geopolitical events with “unprecedented accuracy.” Sure. Time travel, but make it enterprise.

The Claim

Leakers allege IBM has built an internal prototype LLM running on a quantum-assisted backend that allows it to “evaluate probabilistic future states” far beyond classical compute. According to the rumour, this system can anticipate macroeconomic swings, detect emerging crises, and generate high-confidence predictions unavailable to conventional models.

The Source

– Anonymous X/Twitter accounts claiming “inside access”

– A handful of speculative blog posts repeating those claims without evidence

– No technical paper, no demo, no reproducible benchmark

– Zero visibility into the model, the hardware setup, or the supposed quantum workflow

In summary: lots of big talk, no artefacts.

Our Assessment

Quantum hardware is real. Experimental quantum-assisted algorithms are also real. But none of this translates into “predicting the future” in any meaningful sense. Even if IBM were exploring quantum-enhanced optimisation or sampling, it wouldn’t grant supernatural foresight.

Financial markets depend on sentiment, policy, news cycles, human behaviour, and randomness — all fundamentally unpredictable systems. No LLM, quantum or otherwise, is going to reliably foresee stock movements or global events. Best case: fancy maths producing slightly different hallucinations.

What could be real is internal experimentation with hybrid workflows or research prototypes exploring optimisation tasks. Everything beyond that is speculation inflated beyond physics.

The Signal

– Large companies are investing in quantum-adjacent research

– Hybrid compute models will eventually become a real tool, though not magical

– The boundary between modelling, simulation, and hype is getting thin

– Financial forecasting remains a magnet for nonsense claims because it promises easy money

The real story is not “quantum future prediction.” It’s that every new technology attracts people who want it to perform miracles.

Verdict

Rumour Status: ❌ Quantum Fortune-Teller Fanfiction

Confidence: 97%

This rumour is classic hype stacking: take quantum computing (poorly understood), add LLMs (poorly understood), and conclude that together they can see the future. They can’t. At best, you get a slightly different model with a slightly different set of errors — not a crystal ball.

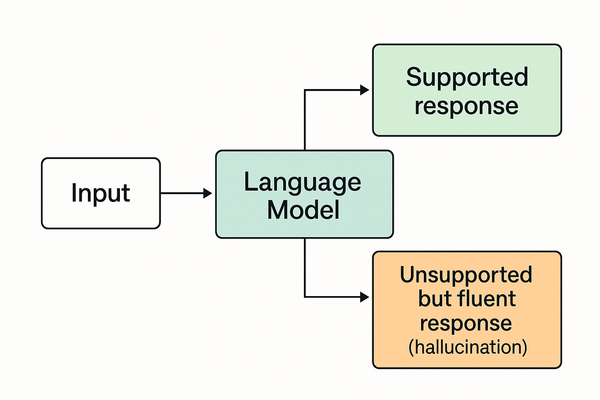

- For a clear explanation of model mechanics, see How Chatbots Work.

- For how companies frame technical progress, see The Benchmark Game.